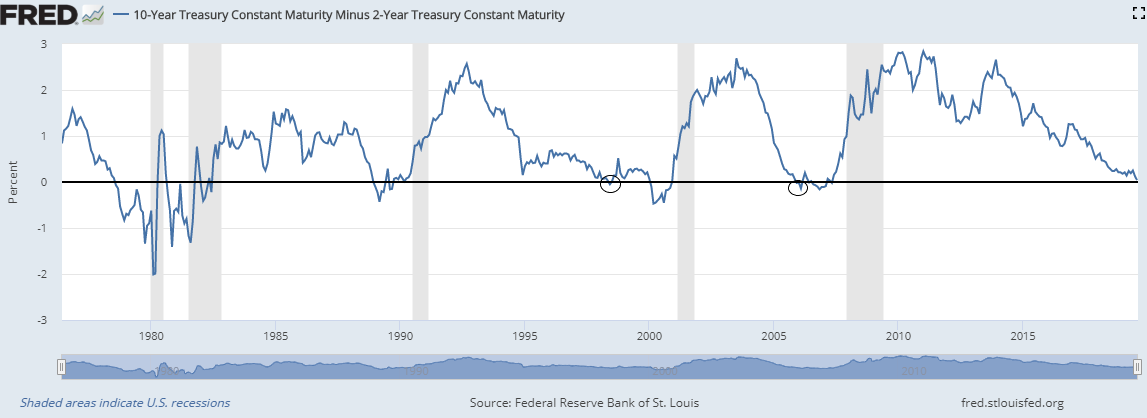

So right off the bat, yes, the yield curve had inverted, but it was only momentarily, pre-market the morning of August 14th, so is this click bait? – Not necessarily. While the yield curve inversion does ring alarm bells, and you should definitely call help, don’t leave the house just yet. The yield curve has predicted a recession the last 8/10 times, sure, but all those recessions had seen an inversion that lasted at least for a month.

But before we get into the nitty gritty of why “this time might be different” (Here’s that again right? Tbh that phrase might just be a more accurate predictor of a recession than anything!) here’s why it inverts in the first place. As investors flock to long-term Treasury bonds in the anticipation of a recession, the yields on those bonds fall. They are in demand, so they don’t need as high of a yield to attract investors. The demand for short-term Treasury bills falls. They need to pay a higher yield to attract investors. Eventually, the yield on short-term Treasury’s rises higher than the yield on long-term bonds and the yield curve inverts.

So, are we headed for a recession? -Not exactly. While the yield curve inversion does heed ominous signs for what’s to come, given that it was just a blip and not a sustained inversion it might be a couple of years down the line. For example, in the years leading up to the great recession, the yield curve inverted briefly for a quarter in 2015, reverted to a standard curve until mid-2006 and then inverted for a year until the recession. But what’s different between then and now is that we’re in a monetary space we haven’t been in since John Law invented the first joint stock company back in the early part of the 18th century. The Fed’s balance sheet’s after undertaking Quantitative Easing “QE” is reducing, but it’s doing so at such a pace that it’s putting a lot of downward pressure on the long end of the yield curve. That along with the negative interest climate in rest of the developed world, and the almost $16 trillion in bonds they issue with negative yields is making positive yields (U.S. treasury issues), however small, much more desirable.

There’s also the case that the fundamentals of the U.S economy for the time being are quite robust. GDP growth stands at 2.1 percent, unemployment claims are falling, consumption looks strong, and there’s the caveat that the Fed might reduce rates even further next month. Sure, business investment has seen a dip, but that’s primarily due to the protracted trade war, which shouldn’t affect the economy in a major way. This is not to say that this time is really “different”. Small banks or asset sensitive banks that use floating interest rates to lend have seen their stock prices plummet recently. Small banks are the first ones to feel the pinch because downward pressure on yields also pulls down the interest they receive on lending.

Overall, while we might be heading for a recession, it’s quite a bit down the line and there’s more than ample evidence to suggest that the yield curve has lost some potency as a recession indicator. So sure call help, but don’t run just yet.

Leave a Reply